Flying by Instruments — Week of August 14, 2023

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -0.27 | 17.42 | 7.89 | 11.95 | 11.41 | 4,464.05 |

| Dow Jones Industrial Average | 0.69 | 7.78 | 8.13 | 10.63 | 9.18 | 35,281.40 |

| Russell 2000 Small Cap | -1.62 | 10.26 | -1.05 | 8.25 | 4.03 | 1,925.11 |

| NASDAQ Composite | -1.87 | 31.04 | 7.74 | 9.04 | 12.74 | 13,644.85 |

| MSCI Europe, Australasia & Far East | 0.59 | 13.57 | 13.22 | 7.81 | 5.31 | 2,153.95 |

| MSCI Emerging Markets | -0.90 | 7.65 | 2.64 | 0.18 | 1.77 | 1,008.34 |

| Barclays U.S. Aggregate Bond Index | -0.28 | 1.01 | -3.20 | -4.65 | 0.44 | 2,069.47 |

| Merrill Lynch Intermediate Municipal | 0.38 | 1.71 | 0.34 | -1.13 | 1.75 | 303.92 |

As of market close August 11, 2023. Returns in percent.

Investment Insights

— Steve Orr

Down the middle

A mixed week across stock indices, some higher, some lower. A typical August to date. Is the sky falling? Hardly. Is the summer rally over? Certainly. Barring some unearthly good news, seasonality and the ever-present Wall of Worry (WoW) are pushing stocks into consolidation mode. Valuations remain fairly full at 20 times earnings. The primary trend continues higher, confirmed by weekly advance-decline lines and moving averages. Daily trend data does paint a slower day-by-day picture as a number of stocks slipped below their 10- and 20-day moving averages. Not enough for a long or intermediate trend change, just slowing the advance. Sentiment peaked in late July; earnings reports took investors’ excitement level down a couple of notches.

Our stock dashboard remains green, with every allocation reading near neutral. In this era of very easy money, that has been a rare sight. Most clients will remember we have allocated more equity risk to the U.S. over international with a bias toward large and growth stocks for much of the last several years. Shifts to “right down the middle” of the strategic weights may be telling us market forces are changing.

Interesting

Long-term interest rates are not a hot party topic. Want folks to leave you alone? Bring up the relative spreads of high-yield and investment-grade corporate bonds versus Treasuries. We’d be glad to get you up to speed. Ten-year rates are key for global sovereign borrowing. Thirty- and hundred-year bonds generally are the province of life insurers, endowments and speculators. The “belly” from three to 10 years is where a lot of corporate borrowers hang out. Banks and savers pay attention to Fed Funds out to two years.

Where will we put a dollar of capital to work? How about 5.4% in six-month Treasury Bills? That should fare well against 4% inflation and be a minimum threshold. Five- and 10-year Treasury bonds are paying 4.3% to 4.15%. The inversion of the yield curve with two-year Treasuries paying 4.9% means the Fed needs to think about cutting rates down the road. Should we earn 1.5% dividends and pay for some option on growth in stocks? How about 7.5% for High Yield? That spread of 7.5% versus Treasuries in the high 4% range is not much to get excited about. Let’s see if a recession will widen that gap.

We think the Fed will raise rates at least one more time later this fall. Recent Fed speakers have reiterated their desire to see inflation continue to fall. The 5.5% upper bound of the Fed Funds range is the highest it’s been since March of 2001. Rates this “high” relative to zero to a quarter of a percent that prevailed for nine of the last fifteen years have to do some damage to the economy.

MARE

One has to dig in certain places to find interest rate damage. The easy mark was housing. Over the last year, sales were hit by buyers not being able to afford the monthly nut and buyers realizing if they sold their home just how much more interest(and principal!) would they have to pay on a new mortgage somewhere else? Result: mortgage originations fell back to 2016 levels. Thanks to higher rates, the Mortgage Bankers Association refinance index fell to its lowest level of activity in 20 years.

Consumer credit rates continue to climb as does used-car financing. More important, and ominous, is that nearly a third of our national debt will have to be refinanced over the next few years. The percentage of D.C.’s budget that goes to interest payments is going to shock Congress. In past debt cycles when the interest burden reached about 14% of the budget, stocks struggled. We are near 10% today.

The Most Anticipated Recession Ever may not be recognized yet. The consensus for a soft landing is growing on Wall Street — with a start date of year-end or early next year. We are increasingly coming to the view that the U.S. is starting a rolling recession either now or in a couple of months. We could be persuaded that it is already underway. Housing is always first, then new orders fall, then earnings and jobs. Was the reduction in job growth last month the first breakdown in job growth? The Fed has another round of jobs and inflation data to consider from August when it meets in late September.

Where next?

July’s consumer price index reading of 3.2% made a nice headline: two months in a row of roughly 3% inflation. One could imagine the Fed cheering “we are almost to 2%!” Not so fast. Those readings were pulled down by low gasoline prices. Gas was pulled lower in part by weak demand for crude for much of the spring and summer around the world, especially in weak China. Concurrently, the Biden Administration was aggressively selling off crude stocks from our Strategic Petroleum Reserve, adding to supply.

The” core” CPI remains well above 2% at 4.7%. Higher recent readings on shelter costs suggest core is not coming down anytime soon. The CPI calculation method suggested to us earlier in the year that inflation will be rising in the fall. We stick by that call and note that crude and gasoline futures have jumped over 10% the last three weeks. Get ready for higher headline inflation.

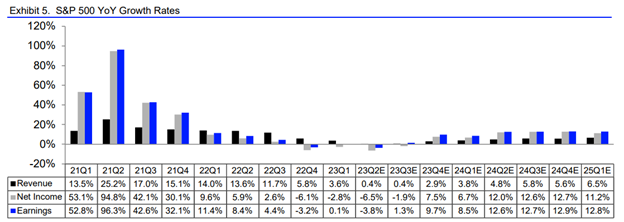

The second quarter earnings season is largely complete. The results were no great shakes. With 456 of the 500 names of the S&P 500 reporting, I/B/E/S calculates the year-over-year earnings decline at -5.4%. That is at least a three-point improvement from last week. The laggard sector was Energy with earnings falling over -47% thanks to lower oil prices from 2022. Consumer Discretionary was the winner, with Amazon carrying the load. The e-retailer beat estimates by an impressive 80%.

In the middle of the I/B/E/S table below, one can see how Wall Street analysts expected a decline of -3.8% versus actual to-date of -5.4%. More important are the next several quarters to the right. Notice how earnings are estimated to sequentially improve. This suggests that they believe the “earnings recession” is about over. If so, that would give stocks support once traders have a better view of Chairman Powell and the Fed’s rate intentions.

Source: I/B/E/S from Reuters

This is Retail Week: Home Depot, Target, Walmart and Ross Stores are the headliners. Deere reports on August 18. We are expecting flat volumes from the retailers. We believe the consumer is stretched and management at those companies may comment on spending patterns. Kellogg and Conagra earnings calls highlighted that volumes were lower.

Wrap-Up

The range of outcomes for stock returns over the next year remains wider than we would like. Safe flying dictates trusting your instruments; in our work, it’s trusting your indicators. Our 4Rs process positions our portfolios at strategic long-term levels of stock exposure, underweight interest rate risk and overweight cash.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.