Hike cycle done, bring on cut cycle — Week of August 26, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.47 | 19.20 | 30.65 | 9.56 | 16.47 | 5,634.61 |

| Dow Jones Industrial Average | 1.29 | 10.56 | 23.16 | 7.35 | 12.24 | 41,175.08 |

| Russell 2000 Small Cap | 3.62 | 10.40 | 21.94 | 1.22 | 10.18 | 2,232.85 |

| NASDAQ Composite | 1.41 | 19.66 | 33.84 | 6.85 | 19.18 | 17,877.79 |

| MSCI Europe, Australasia & Far East | 2.77 | 11.79 | 21.49 | 4.69 | 9.30 | 2,439.48 |

| MSCI Emerging Markets | 0.70 | 9.86 | 15.30 | -1.70 | 5.38 | 1,100.68 |

| Barclays U.S. Aggregate Bond Index | 0.67 | 3.60 | 8.89 | -1.92 | 0.10 | 2,239.80 |

| Merrill Lynch Intermediate Municipal | 0.37 | 1.20 | 5.69 | -0.26 | 1.06 | 318.66 |

As of market close August 23, 2024. Returns in percent.

Investment Insights

— Steve Orr

Almost

For the vacationers among us, the major indices have climbed a half and one and half percent this month. What did you miss while at shore? How about a 6% drop in the S&P 500 followed by an almost 8% rise? Sounds like fun, or the makings of a longer and deeper correction? Most market watchers would come down on the side of “fun,” but we see the price action differently.

Over the past 10 years, the S&P 500 has eked out a +0.25% gain on average for August. That includes a -6.3% drop in 2015 and 7% runup in 2020 as reopening took hold. The prior 70 years, the index averaged a 0.01% gain or really just flat. That dull summer average means August ranks 10th out of the 12 months in performance. So, as August is almost over, we should be grateful for positive returns. But why are returns edging slightly ahead of average with our wall of worry?

Driver

The dominant force discussed in modern markets is the price of money, or for academic types, the interest rate. Most investors assume the Federal Reserve can dial up or down economic growth by changing interest rates. They also have come to believe that interest rates can control inflation. Let’s put both of those notions in the “sorta true” fact check bin.

Last Friday at the Jackson Hole Symposium, Fed Chairman Powell said, “The time has come for policy to adjust. The direction of travel is clear.” At the September meeting, the Fed will cut short-term interest rates. Most likely it will bring the Fed Funds target range down by a quarter of a percent from 5% to 5.25% to 4.75% to 5%. A drop of a half of a percent would require the jobs data on September 6 or inflation on the 11th to be materially weaker than expected.

Powell’s speech represents his fourth rate “pivot” since October 2022. Markets, especially housing, have clamored for rate cuts for the past year. Most economists agree that rate hikes and cuts take a year to 18 months to have full effect on the economy. In econ speak, we are just now feeling the effects of the last rate hike back in July of last year. A quarter point drop next month will be more market mental than wallet impact. For sure, the housing market will rejoice — they have taken the brunt of higher rates since this cycle began in March 2022. If the Fed follows market pricing on Fed futures, you should expect short-term rates to be at least 1% lower in six months.

This does impact some investors and certainly our senior savers. Money market funds today pay just over 5%. With inflation running at 3%, the Fed views that 2% gap as restrictive. We agree if that is the only metric one uses. And we would point out that a year from now after five or more cuts totaling 1.5%, Fed Funds rates of 3.5% will still be restrictive.

The rest

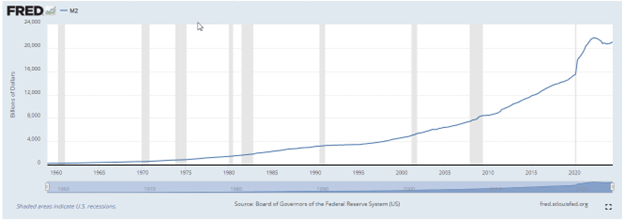

Thank you, Paul Harvey, “And now the rest of the story.” Credit spreads, commodity prices and, finally, liquidity, play a large role in the economy and inflation levels. Credit spreads, the added percentage tacked on to U.S. Treasury rates that corporations pay to borrow, are historically low. Commodity prices are relatively tame, helping producer prices. M2 is the Fed’s measure of cash, bank deposits and money market funds in the financial system. The St. Louis Fed code is M2SL (fred.stlouisfed.org). The money supply roughly grew at the rate of GDP growth until the GFC in 2008. Since then, the Fed has managed reserves, or excess cash, in the banking system by adding or subtracting cash through sales of bonds from its portfolio. The U.S. Treasury has pitched in, holding more or less cash in its Treasury checking account at the Fed. The growth of M2 from year to year is a key determinate of inflation. Too much money chasing the same amount of goods pushes prices higher. This is what happened over the past three years as the administration dumped cash into taxpayers’ pockets. Note the jump in M2 over the past couple of years:

Source: https://fred.stlouisfed.org/series/M2SL

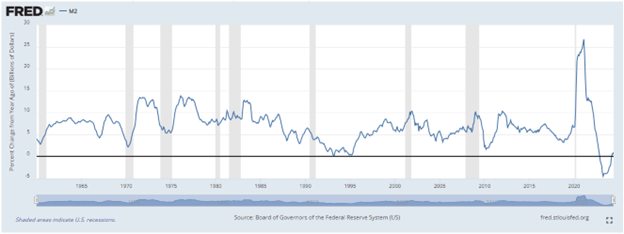

Most folks think Paul Volcker was a hero because he cranked up interest rates to kill inflation. He did raise rates to slow the economy somewhat. Inflation was killed when he ratcheted down M2 growth. Here’s the annual change in M2. Note the spike during and after shutdowns. Now you know why eggs are $4 a dozen instead of $1.50.

Source: https://fred.stlouisfed.org/series/M2SL

Chairman Powell and the FOMC have given up on inflation, admitting that 2.5% to 3% is OK. Instead, they are focusing on jobs. We note that Congress is partly to blame. They changed the Federal Reserve Act to require the Fed to work toward full employment. The money line in Powell’s speech: the Fed would not “welcome further cooling in labor market conditions.”

Likely the annual BLS update of their nonfarm payroll numbers gave the FOMC members the cover to cut rates in September. Generally, the estimate for the trailing year is up or down 0.1%. The update released last week for the March-to-March period was a drop of 0.5% or 818,000 net jobs. In other words, the BLS has overstated job growth each month by around 68,000 jobs on average. The only sector that grew in jobs was Federal and state government. This was the largest adjustment since the 2009 recession.

Fewer jobs created fits with the slowdown in consumer spending and dwindling savings we have been seeing over the past several months. As more data comes in, we may find the job market was weaker than even the BLS revisions suggest. A year from now, we could once again be wagging our finger at the Fed saying, “late again.” Meanwhile activity is ticking along just enough for a second gear level in the economy. The Most Anticipated Recession Ever (“MARE”) is still on the horizon. Perhaps we are walking on an economic treadmill or it’s a slow growth remake of “Groundhog Day.”

Wrap-Up

No more guessing about a rate cut in September. Now the debate is about how much. On September 19, the discussion will shift to how far down and how fast the Fed will go. A low (more accurate?) jobs number or higher inflation would spook the Fed toward a half of a percent.

Gold hitting all-time highs is telling you the inflation story is not over. Rates at nearly 1% lower than three months ago are telling you growth is slowing. We think a path higher for prices in the coming weeks will be rocky and difficult. Stay patient.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI