Shaken but Not Stirred — Week of August 5, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -2.05 | 12.99 | 20.53 | 8.18 | 14.59 | 5,346.56 |

| Dow Jones Industrial Average | -2.10 | 6.56 | 15.16 | 6.36 | 10.75 | 39,737.26 |

| Russell 2000 Small Cap | -6.66 | 4.85 | 9.14 | -0.38 | 7.99 | 2,019.27 |

| NASDAQ Composite | -3.34 | 12.20 | 21.15 | 5.22 | 16.94 | 16,776.16 |

| MSCI Europe, Australasia & Far East | -1.95 | 4.80 | 11.40 | 2.54 | 7.52 | 2,291.33 |

| MSCI Emerging Markets | -0.99 | 5.70 | 7.48 | -3.51 | 3.97 | 1,061.23 |

| Barclays U.S. Aggregate Bond Index | 2.43 | 3.21 | 8.42 | -2.21 | 0.35 | 2,231.39 |

| Merrill Lynch Intermediate Municipal | 1.03 | 1.06 | 5.17 | -0.38 | 1.19 | 318.22 |

As of market close August 2, 2023. Returns in percent.

Investment Insights

— Steve Orr

Less good = bad

Well, that was interesting. We are writing this on the morning of the 5th and including the first two days of August with July in our market comments. We and others have repeatedly commented this year on how the Magnificent 7 and AI-related stocks had zoomed away from the rest of the market. “Meme” and “bubble” were beginning to get tossed around as well as comparisons to the late 1990s dot.com bust. No matter, through the first two weeks of July the S&P 500 gained 3.7%, the NASDAQ 4.4% and their (very) little neighbor the Russell 2000 Small Cap index hammered out a whopping 10.5% two weeks for the first time in over a decade. What changed to start a rotation from large to small?

In mid-July stories began to circulate that the administration was considering tougher restrictions on sales of chips and technology to China. That sparked selling in the semiconductor stocks. As earnings season got underway doubts surfaced about whether all the money companies are spending on artificial intelligence will payoff anytime soon. Several of the Magnificent 7 had earnings that were not so Magnificent, and suddenly traders are looking for the exits.

A brief review from our note two weeks ago: Traders for the past couple of years have borrowed cheap Japanese Yen, bought mega tech stocks and ETFs and shorted small cap stocks and their ETFs. An improving stock market and rising interest rates pressured that trade. Mix in the trade worries above, possible Fed rate cuts and a slowing economy — it’s time to unwind that trade. Please do not fall for the rotation script in the media: that small caps will do better in a lower interest rate environment. First, small caps do best in the early stages of a cycle. We are late cycle. Second, any CFO of a small cap company that has not swapped, capped or otherwise engineered her interest expense should mail her MBA diploma back to the school. Third, now that rates are shifting down, that actually helps mega-tech stock prices because they are valued as a perpetual free cash flow divided by the interest rate. OK, back to our regularly scheduled programming.

Big change

Last Wednesday, the Fed left rates unchanged and issued a fairly hawkish (keep rates high) toned press release. As he has for the past several meetings, in his press conference Chair Powell stated that a rate cut would be on the table in the September meeting. Market lemmings were already pushing stocks higher in anticipation of just that sort of statement and proceeded to push the S&P 500 to a 1.6% gain.

Lost in the excitement was a three-pronged test Powell laid out for rate cuts. “If we see inflation moving down, growth remains strong and employment is good, then September rate cut could be appropriate.” Well, for a Fed Chair that is screaming with a megaphone. Traders were left speculating the age-old Fed worry: “What does the Fed know that we don’t?” Let’s break this statement down.

Down?

Is inflation moving down? Goods inflation coming out of shutdowns is over. Labor, services and healthcare costs have moderated. Rents and housing are still a problem but the cure for high prices is usually high prices. Headline CPI still hovers around 3% and the Fed’s measure, Personal Consumption Expenditures, is hovering around 2.5%. Not the 2% goal, but in the neighborhood. We would point out that summer readings on CPI the past two years have dipped, only to rise in the fall. Shelter, the measure of mortgage and rent payments, should be on a downtrend, but that series is reported on a six-month lag. So, mark this one weak positive for a rate cut.

Strong?

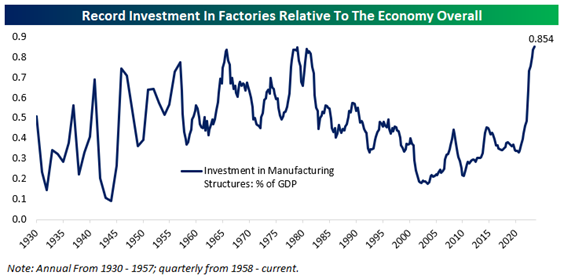

GDP growth in the second quarter was a comfortable 2.8%, up from the first quarter’s 1.4%. Getting better, right? Cue Corso: “Not so fast, my friend.” Strip out net exports and you have the mouthful, “Real Final Sales to Domestic Purchasers.” As long as this series is above 2%, no recession. The first half of 2024 this series posted 3%+ growth. One key contributor to that series was “Nonresidential investment in manufacturing structures.” This line item contributed 0.85% of the second quarter’s 2.8% rise. Where did all those buildings come from? These are the EV battery and chip plant spending items from the CHIPS Act and “Inflation Reduction Act.”

Source: Bespoke Research

In other words, if Congress had not increased the national debt to spend billions on new plant construction, then the second quarter results would have been much closer to our 2% recession alert line. Like, right on it.

Stripping out those new plants helps the weaker growth news make sense. Consumer spending has been sliding lower since the spring. Credit card delinquencies have been rising. Only 1.1% of credit card balances were 60 days or more past due in 2021, now 2.6% in the first quarter. Business inventories added 0.82% to GDP in the second quarter. The positive view would be re-stocking from pandemic-era shortages. We do not give that theory much weight, believing a lot of our clients learned lessons in supplier management. Instead, rising inventories better fit what we are hearing from the field: that orders are slowing, or customers are changing delivery times because they do not need product.

More recent economic data supports our thesis that the economy is sequentially slowing. The data does reach a recession destination, but we can see the off ramp. Score GDP growth weak but neutral. Whether the economy steers past that off ramp or stops at the No Growth Stucky’s depends on job growth.

Now bad = bad

Friday’s 114k June payroll report missed analysts’ expectations of 175k. The prior two months were revised down another 29k. The unemployment rate rose to 4.3%, triggering the Sahm Rule. Hurricane Beryl messed with the July sample week, spiking the unemployed worker series. Without that spike, household employment would be 200k higher, keeping the unemployment rate unchanged at 4.1%. Barring any other changes, look for unemployment to reverse next month.

The Sahm Rule is named after former Fed economist Claudia Sahm. The rule states that a recession is likely already underway if the three-month average of the unemployment rate rises a half of a percent from its low over the past 12 months. It has an unbroken track record since 1970. Factoring in the hurricane issues, we wonder if the Sahm talk is a month or two early — or even a false signal. Employment is always the last indicator to roll over, usually several months after a recession started. Mark the jobs situation as a question mark for now. Will the hurricane numbers reverse next month, or are rising jobless claims a warning sign?

So, score Powell’s report card: inflation = cut, growth = leaning cut, jobs = waiting. By Wall Street logic, a September cut is baked in for sure.

Coming on the heels of weak manufacturing surveys and pending home sales, one could wonder if we are in a recession? Traders did not wait to find out. From the end of Powell’s press conference through Friday’s close, the S&P 500 fell 3.5% and the NASDAQ 5.1%. The market cap musical chairs game left the Russell 2000 Small Cap out with a drop over the same period of 8%. Most of the damage was done on the open Friday, after the jobs number came out.

Rates markets had similar reactions. The 10-year Treasury had been on a downtrend since April, quietly signaling slower growth in the future. Over the six trading days ended Friday it decided to stand up and wave a white flag, surrendering to lower rates and demanding a faster acting Federal Reserve. From April through July, it dropped a half of a percent, to 4.20%. Those most recent six days pulled another 0.44% out of the yield, with nearly half that drop coming in Friday’s trading, finishing the week at 3.79%.

That was the 10-year’s largest decline since the GFC. Two-year Treasury Notes fell similar amounts, and now yield 3.87%. We expect the inversion of two-year yields being higher than 10-year yields to end soon. One key driver of that move was the announcement by the Treasury that they will borrow only $740 billion in the third quarter. That is $106 billion less than last quarter’s estimate. The borrowing estimate for the fourth quarter dropped also. Less supply helps bond dealer inventory and reduces pressure on prices.

Narrative shift

Markets always overshoot, and in both directions. The reality of a slowing economy was easy to ignore in the face of artificial intelligence growth. A soft landing was in the cards for the rest of the economy, according to Wall Street. Throw election uncertainty, the chance for greater conflict in the Middle East, so-so earnings and now a weak job report in the mix, and you get a Wall Street narrative change.

The new narrative is no longer soft landing, but how far behind is the Fed in cutting rates. Ergo, Citi and Goldman Sachs tried to get ahead of the narrative by forecasting two half-percent cuts beginning in September. Remember, rates anticipate Fed moves and stocks anticipate, well, supposedly earnings, but sometimes also hoped-for earnings. Fed futures and the two-year Treasury Note are now projecting at least four rate cuts in the coming months.

We stick by the idea that the slowdown is here, but not deep enough to warrant a rate cut before the election. An unheard-of change in policy (from going higher to cuts) just before an election would signal that the Fed does worry there is something wrong beneath the income statements. We do recognize that since the Greenspan era, the Fed follows the futures market from about 10 days before the meeting. Between now and the September 18 meeting the Fed will have two more inflation readings and the August employment report to consider.

Stocks entered a historically choppy season from the middle of July through the end of September. Since 1950, August ranks 10th in performance for the Dow and S&P 500. The Magnificent 7 did help earnings last week and were buttressed by pleasant surprises in Financials, Tech and Utilities. Microsoft, Meta, Amazon and Apple all beat, but gave varying outlooks for the rest of the year. Analysts hoped for earnings gains of 9.9%, after 75% of the S&P 500 have reported gains are running a nice 11.3%. Watch top-line sales, however, as less than half of the reporters are posting positive sales growth.

We are past the halfway point in the second quarter earnings season. This is “healthcare” week: Lilly, Novo, CVS, McKesson, Gilead and Amgen are some of the headliners. Caterpillar will give us a read on all that factory construction.

The mid-single digit drops since July’s highs are not uncommon for stock markets, especially with the recent volume of outside news. Most years see three to four consolidations of 5% or more. Most years have around eight drops of 2%. In this Bull cycle, there have only been two days where the S&P 500 has dropped 2% or more. So, recency bias makes people feel that the market is in worse shape than it actually is. The NASDAQ, after a great first-half run, has entered correction territory with a 10% drop from its last all-time high on July 10.

Two final items we are watching: First, this now an Open Election — the sitting president is not running. Both the Dow Industrials and S&P 500 average flat to small loss returns for the year in these years. Second, credit spreads, the amount of interest companies pay to borrow over and above the U.S. Treasury, have started to rise. That can be a warning sign of further slowdown as they continue to rise.

Time to buy the dip? Let’s get through earnings season and a few other outside events. Our sense is these levels will be available, even after a “Turnaround Tuesday.”

Wrap-Up

The economic evidence we have in hand suggests 1.8% to 2% growth this quarter. Definitely slower than a year ago, but not yet recessionary. The impressive drop in Treasury yields will help housing and mortgage production.

Congress continues to run a spending deficit of nearly 7% of GDP. Those expenditures, whether on chip plants or submarines, create steady momentum into next year. Earnings are coming in ahead of estimates, but weak sales growth means it will be months before uncertainty clears.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI