Narrow and waiting — Week of July 8, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.98 | 17.57 | 28.09 | 10.31 | 15.07 | 5,567.19 |

| Dow Jones Industrial Average | 0.69 | 5.52 | 18.45 | 6.58 | 10.19 | 39,375.87 |

| Russell 2000 Small Cap | -1.01 | 0.70 | 11.65 | -2.44 | 6.56 | 2,026.73 |

| NASDAQ Composite | 3.51 | 22.73 | 35.26 | 8.66 | 18.59 | 18,352.76 |

| MSCI Europe, Australasia & Far East | 2.18 | 8.08 | 17.62 | 4.13 | 7.42 | 2,364.30 |

| MSCI Emerging Markets | 1.95 | 9.70 | 15.30 | -3.49 | 3.69 | 1,104.88 |

| Barclays U.S. Aggregate Bond Index | 0.71 | 0.00 | 4.69 | -2.95 | -0.06 | 2,161.93 |

| Merrill Lynch Intermediate Municipal | 0.17 | -0.58 | 3.00 | -0.71 | 1.08 | 313.06 |

As of market close July 5, 2024. Returns in percent.

Investment Insights

— Steve Orr

Yes

It is a Bull market until proven otherwise. Do we like Bulls? You bet. Do we like everything about them? No and there are a lot of reasons to be wary of this Bull. Regular readers know we go on about breadth and participation by all stocks. We like to see rising numbers of new highs and falling new lows. The percentage of stocks above their 200, 50 and 10 moving averages. And a good portion of the index components above the return of the index.

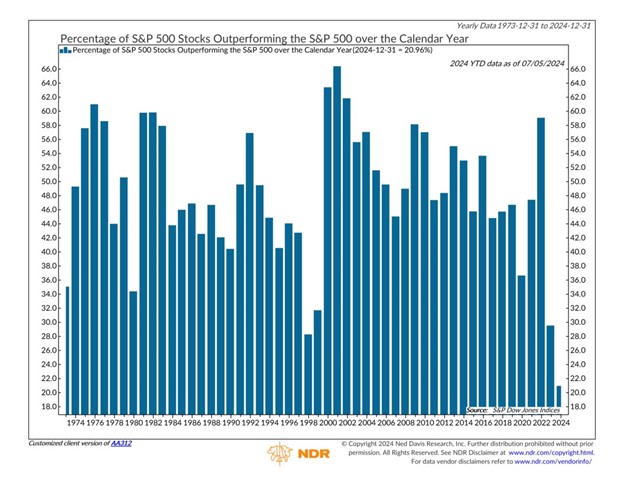

In an early to mid-cycle Bull, one would expect about 40% of the index components to be performing at or above the index return. There are always winners and losers. The artificial intelligence theme combined with Congressional spending in semiconductor plants and alternative energy have focused markets on just a few winners recently. We can see this below in the handy chart from Ned Davis Research. Today the fewest number of companies are beating the S&P 500 in fifty years. In other words, the 50%+ year-to-date performance of the 13 stocks like Western Digital, Lilly, Broadcom and, of course Nvidia (+160%) have dragged the other 487 stocks to a fine index return of +17.6%.

The question is how long this narrow breadth can last. We do not know, nor does anyone else. And it is not time to pack up and go home. The Fed is on hold, earnings season is staring later this week, buybacks will turn on after earnings. More stocks can participate, or tech can turn and take a welcome correction, resetting valuations and sentiment for future gains. Either would be welcome and neither is likely until we slog through the summer.

For whom?

We wonder about who is getting the new jobs in the Bureau of Labor Statistics reports. The monthly survey estimates of payrolls and households released last Friday was a repeat of the last several months. Nice headline beat, 206,000 net new jobs versus estimates of 190,000. But 70% of the new jobs were either in government or health care. Since the health care system is heavily dependent on Medicare and Medicaid transfers, think of health care as quasi-government.

For the first time in quite a while the government and health care numbers are averaging at least 50% of the net new jobs each month. Typically, one would expect the government and health care portion to stay constant around 20% to 25%, consistent with the overall economy. April was the peak (hopefully) when those two groups totaled 91% of new jobs.

Payroll growth this year has averaged 220,000 per month. For those of you scoring at home, when payrolls fall to around 50,000 per month over several months its time to stock up on canned goods. When they are averaging 400,000 per month, we are either coming out of a recession or times are so good everybody is working a second job, and your grandmother came out of retirement.

A growing private sector hires more people and pays more taxes. More taxes are necessary to pay the increased number of government workers. You get the idea. Also consistent with recent payroll reports, the prior two month’s numbers were revised lower.

The unemployment rate ticked up another tenth of a percent to 4.1%, exceeding its pre-shutdowns average of 4% for the first time. It bottomed in the current cycle at 3.1% in January of 2023. Recall two years ago when the Fed first raised short-term rates, they were very vocal about pushing unemployment to 4.5%. The academic thinking was that by raising rates high enough employers would layoff or fire some 1.5 million workers to move the unemployment rate to 4.5%. That would slow wage inflation and bring down the consumer price index.

And now…

For the rest of the story, we should turn to our history books. Inflation always pops higher after a recession. Goods demand rises but either there is no inventory or inventory is in the wrong place. Prices rise until demand is met and/or consumer switch to another alternative good.

The recession of 2020 caused inventory drops and shipping snarls. Raw materials could not get delivered and finished goods sat on loading docks around the world. That inflation period ended a year or so ago. Meanwhile services inflation – think fast food, nurses, etc. started rising and continues to grind higher, running above 4% this year. Couple that with income growth around 3%, higher mortgage rates and higher home prices and you get consumers who spend less. Consumer and wholesale price inflation for June will be released Thursday and Friday. Expect CPI to drift a bit lower to 3.1% and PPI stay steady at 2.3% We would note that since last month’s survey period both wholesale gasoline and crude oil are up 4%.

Lower spending shows up in the last three months of lackluster Retail Sales figures. June’s retail and industrial activity was notably lower than April’s. That shows up in the Atlanta Fed’s GDPNow tracker which fell from north of 4% to today’s 1.5% growth for the second quarter. Hello slowdown.

Report cards.

While the “real” economy was slowing, traders are hoping company revenue and earnings did not. We are impressed that Wall Street continues to project 8.8% growth for second quarter earnings over last year’s quarter. FactSet reports that is the highest year-over-year earnings growth since the first quarter of 2022. Recall the last six quarters: three of negative earnings, then three that are basically flat. Now after a quarter of declining economic activity, Wall Street forecasts 8.8% growth in earnings for the S&P 500.

Put us in the skeptic camp. Yes, big companies guide Wall Street and analysts have a habit of reducing estimates just before earnings come out. FactSet pointed out last week that the lead up to this next season has seen the smallest revisions in several years. In other words, Wall Street is pretty confident in that 8.8% number. Recall we were seeing estimates around 10% for the second quarter back in the fall. That is not much of a drop.

So why the optimism? We think it is optimism about the Communications Services sector and mega-tech earnings. Communications Services is an odd place for Google, Fox, and Electronic Arts. We get AT&T, Charter and T-Mobile being in that sector. Since April, Google (Alphabet) is up 24% and Fox 13%. Disney and Warner Brothers are bringing up the rear, down 17% and 15%, respectively.

The top 10 stocks in the S&P 500 make up 36% and the top 5 are 27% of the index. This is the highest concentration we have seen since the early 1970s. Prior to the 1972 Bear, the Nifty Fifty dominated portfolios. A portfolio manager had to own some portion or all of those names if she hoped to stay within shouting distance of the S&P 500’s performance. Those Blue Chips are easy to remember: Eastman Kodak, Dow, Avon, Sears, Texas Instruments, General Electric for starters. Ouch. Two are dead and most of the rest operate in different markets or industries than they did then.

Concentration may not be a bad thing - after all the stock index in most countries is dominated by one or two big companies, usually with government ties. We prefer a broader market where all stocks are rising based on earnings projections coming from an improving economy. We are past that point in this cycle. Earnings for the second quarter are riding on those big names at the top like Amazon, Nvidia, Apple and Google. The information tech sector’s second quarter earnings are expected to rise 18%.

This earnings season kicks off Thursday with Pepsi, Delta and Conagra. Friday is the “unofficial” start with the big banks reporting. Wells, JP Morga and Citi’s loan, fee and deal growth will be examined for the Fed’s “Higher for Longer” interest rate impacts. BlackRock and Goldman follow on Monday. 40% of the 53 reporting companies over the next 7 days are in the financial sector.

Wrap-Up

Hurricane season came early this year as Beryl works its way through Texas. We are more concerned with outside events affecting markets and our portfolios. Storms come in many fashions. The French and U.K. elections saw voters move to the left politically for leadership to improve their economies. There may some shift in our electoral politics before the conventions.

Our indicators point toward global expansion of around 2.5 to 3% GDP growth this year. The U.S. pulled the wagon last year; this year we will lag in the middle part of the year. Wall Street expects earnings growth to improve over the next several quarters. A stronger economy would help.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI