Powell to markets: We’ve moved on from inflation — Week of March 25, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 2.31 | 10.11 | 34.63 | 11.92 | 15.20 | 5,234.18 |

| Dow Jones Industrial Average | 1.97 | 5.25 | 25.57 | 8.97 | 11.48 | 39,475.90 |

| Russell 2000 Small Cap | 1.61 | 2.51 | 22.29 | -0.45 | 8.00 | 2,072.00 |

| NASDAQ Composite | 2.87 | 9.64 | 40.55 | 8.38 | 17.56 | 16,428.82 |

| MSCI Europe, Australasia & Far East | 1.40 | 5.95 | 18.68 | 5.40 | 7.93 | 2,356.36 |

| MSCI Emerging Markets | 1.39 | 2.83 | 10.49 | -4.75 | 2.64 | 1,048.34 |

| Barclays U.S. Aggregate Bond Index | 0.40 | -1.33 | 0.73 | -2.72 | 0.32 | 2,133.30 |

| Merrill Lynch Intermediate Municipal | -0.11 | -0.23 | 3.23 | -0.12 | 1.67 | 314.17 |

As of market close March 22, 2024. Returns in percent.

Investment Insights

— Steve Orr

Fun run

Yes Virginia, it’s a Bull market. Another week, another all-time high for U.S. stocks. “Broader” participation last week as the S&P 500 pulled the NASDAQ and Dow Industrials along for the ride. This marks the 20th new high for the S&P 500 this year. Certainly, we are impressed by the speed of the big index’s run toward our 5,300 full-year target. Should we call and raise our target? Can the Bull continue? We believe it can, but the Bull could use a water-and-feed stop before trotting higher.

A water-and-feed correction would ease overbought conditions across multiple sectors. What makes us a bit nervous in here? Oh, just a slew of flags. To wit: Forward price to earnings is now north of 21 times, implying more growth in earnings than Wall Street is projecting for the next couple of years. In 50 trading days through last Friday, the big index has posted a 52-week high 22 times. The index has been in overbought territory for nearly the entire time. At some point overbought markets correct themselves.

Sentiment is not euphoric but certainly “very confident” that the Bull will continue. Healthy double-digit gains over the past year imply a liquidity drain from stocks and money market funds to the Treasury’s General Account as capital gains taxes are paid. The trend is the primary driver, not valuation or sentiment in this rally.

The typical pattern in an election year is weakness in the spring (again, think tax season) and late summer, followed by a rally after the election. Given the amount of spending by Congress and the administration this year (Inflation Reduction Act, CHIPs, etc.) we think enough monetary grease is available to avoid a recession and support steady growth.

2nd gear

There is just a week left in the first quarter, and early data are tracking for a low 2% growth rate. Fancy math says that is two-thirds of the fourth quarter’s 3.2% rate. Over the past 18 months we have slogged through a housing recession and manufacturing recession, and now it’s the consumer’s turn to slow down. Retail sales have turned negative over the past three months, and that includes December.

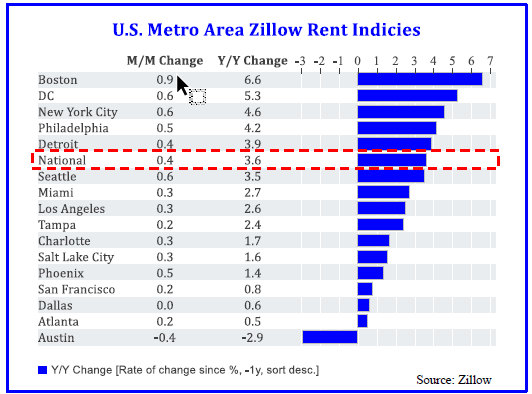

Housing responds to interest rates. The Fed’s stance toward lower rates has helped starts and permits bottom and begin to turn higher. New mortgage origination totaled $1.6 trillion last year and is on pace to hit $2 trillion this year. Depending on where you live, the apartment boom and tech layoffs may have an impact. Here is recent Zillow data compiled by Strategas:

The Federal Reserve system has 11 regional banks. These banks serve as currency- and money movement-clearing agents for banks in their respective regions. All produce economic data and surveys of various conditions. Five of the 11 produce regional manufacturing and business indices each month. Dallas, Richmond, Philadelphia and Kansas City surveys are all in some level of contraction over the past several months. Only New York Fed’s Services index shows positive growth month over month.

The only “big” economic data this week are the final estimate of fourth quarter GDP and, on Friday, the Personal Consumption Expenditure index. This is the Fed’s favorite inflation indicator, and it should stay comfortably in the low 3% range.

More grease

My entire career, the Fed has been focused on inflation. Dutifully, the Fed’s meeting press release last week reiterated that theme. “No cuts until sustainable progress toward 2% inflation,” to paraphrase the release. When will 2% be reached? you ask. The Fed staff’s new projection says 2% will not be reached until 2026 — right about when Powell’s term ends. A gentle reminder to our readers: Prices are up 17% over the past three years.

And inflation remains sticky in the mid 3%s as measured by the consumer price index. That series bottomed at 3% even last June. Apparently, we are going to make significant progress in reducing inflation in the next couple of months because the futures curve is calling for first cut at the June meeting. We will cut the analysis short with this summary: The Fed statement was appropriately hawkish focused on inflation and balance sheet winding down.

But — Powell’s press conference was just the opposite. He would not address why rate cuts are needed, would not address direct questions on why inflation has been rising the past couple of months. Finally, he did say that the Fed would slow or stop reducing their purchases of Treasury bonds (“QT”). In other words, Powell is saying we, The Fed, are going to buy more government debt to fund the deficit and administration funding plans and do it at cheaper interest rates. Accordingly, the Senate approved a $1 trillion stop gap budget bill over the weekend that is only 1,012 pages long and contains 1,400 earmarks for local pork-barrel spending.

But gold is also rallying, unusual when stocks are flying high. Hedge Funds have bought more than 200 tons this year, adding to the momentum from Central Banks and speculators. Gold is telling you there is a lot of money sloshing around and to be ready for something. Could that be commercial real estate loans maturing over the next year? We, and I am sure that the Fed, would like to avoid that problem. Is that why the European Central Bank, Bank of England and the Fed all want to lower interest rates? From the perspective of stock, commodity and bond markets, lower rates just add grease to the markets.

Waiting

This is a holiday-shortened week. It is also quarter-end, and we should expect portfolio managers to reshuffle their portfolios. Let’s round off most quarters to 13 weeks. Six of those weeks are during earnings season, and most of the quarter’s gains are centered around the run-up and release of company earnings reports. The other seven weeks, markets stare at the Wall of Worry, thumb twiddle and generally make up things to worry about. Some humans do the same.

The fourth quarter earnings season finished about average. Seventy-eight percent of the S&P 500 members best consensus estimates for earnings. For the full year, 2023 earnings for the index rose 8.4%, a good year considering pressures from rising interest rates and geopolitical uncertainty. We are now in wait mode for first quarter results. The big banks will kick off the unofficial start on Friday, April 12.

Wrap-Up

Our economy is “rolling” through slowdowns in various sectors. Manufacturing continues to lag; homebuilding and services are improving. The consumer, at nearly two-thirds of GDP, will have the last say. Inflation is clearly hampering spending.

Anecdotal comments from company managements suggest the consumer is pulling in their spending. Unfortunately, we are in the “dead” period for another three weeks before earnings reports shed some light on earnings and corporate outlooks. This Bull cycle may be stretched a bit but is not over.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI