Seasonals need boost from earnings to break out in a rally — Week of October 16, 2023

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 0.47 | 14.17 | 19.89 | 8.89 | 11.23 | 4,327.78 |

| Dow Jones Industrial Average | 0.79 | 3.29 | 14.52 | 7.64 | 8.16 | 33,670.29 |

| Russell 2000 Small Cap | -1.47 | -1.21 | 1.02 | 2.95 | 3.50 | 1,719.71 |

| NASDAQ Composite | -0.18 | 28.94 | 27.03 | 5.00 | 13.35 | 13,407.23 |

| MSCI Europe, Australasia & Far East | 2.39 | 8.17 | 27.74 | 5.54 | 5.27 | 2,040.99 |

| MSCI Emerging Markets | 2.73 | 3.16 | 16.04 | -2.67 | 2.45 | 962.69 |

| Barclays U.S. Aggregate Bond Index | 0.48 | -1.90 | 0.98 | -5.45 | 0.06 | 2,009.85 |

| Merrill Lynch Intermediate Municipal | 0.96 | -0.69 | 2.37 | -1.60 | 1.49 | 296.76 |

As of market close October, 13, 2023. Returns in percent.

Investment Insights

— Steve Orr

At it again

We frequently refer to the S&P 500 stock index, since it is familiar to most of our readers. Our actual global benchmark, the MSCI All Country World, or ACWI, is not the first index to jump to mind. It is, however, a better view of what is happening around the world. Both the global and U.S. indices peaked at the end of July and spent the last two months in downtrends.

Mid-month brings the start of third-quarter earnings season and an opportunity for stocks to fight headwinds and climb higher. We also are waiting to see if the usual fourth quarter strength for stocks emerges. Note the last few candles on the right side of the S&P 500 chart. They are having trouble breaking through resistance in the 4,375 area. Closing the chart window up to 4,400 would give the big index a chance to assault 4,500 and get the Bulls cheering.

Source: Bloomberg, L.P.

The ACWI includes developed international and emerging markets. The 25 country MSCI Emerging Markets index is dominated by China, at about a 30% weight. Its chart is similar but lacks that chart gap, or window. These usually occur because of an event or news outside of market hours. If prices rise and fill the gap later, then traders have incorporated the news into their outlook. Note that prices continued lower on the ACWI chart, suggesting that markets have a more dour view of international stocks at the moment.

Source: Bloomberg, L.P.

What’s Up

September’s Consumer Price Index clocked in at 3.7%, slightly above expectations. Shelter (housing and rent prices to you and me) were fingered as the culprit. For some reason apparel costs suffered a big drop last month. Well, we did not see that happen in the stores around here. We think the Fed is aware of two trends in the inflation series: 1) medical cost increases hit starting in October, and 2) average inflation rates. If we run the next several months at the trailing twelve-month average of 0.4%, inflation should finish the year at 4% or higher. The age of low rates and inflation is officially over.

From the Fed’s viewpoint, a number of price components are moderating, specifically food and gasoline. Three FOMC members were on the tape last week with a new message. A reader’s digest version: “the recent rise in long-term interest rates may do the Fed’s work for us.” Hang on a minute. After months of telling us they were “data dependent,” now they can sit back and watch? Sounds like a policy change to us. Four Fed members speak this Tuesday. Chairman Powell speaks on Thursday, just ahead of the blackout period that starts this Saturday.

Wind the clock back three years. The stimulus spend, spend, spend by Congress created the new rising inflation cycle. A year later the Fed responded by raising interest rates, hoping to cool wage inflation and slow job growth. Recent WARN data suggests that may be happening. You should expect to see jobless claims rising in the next couple of months.

Happy time

Can we have positive earnings growth for the first time in three quarters? The big banks that reported on Friday had lower charge offs and higher net interest income than projected. That was a good start. FactSet quickly revised their quarter projections to include Friday’s releases and concluded that the S&P 500 as a whole could post positive earnings of 0.4% and year-over-year revenue growth of almost 2%. Not bad given higher interest rates and “imminent recession” projected by Wall Street for the last two years.

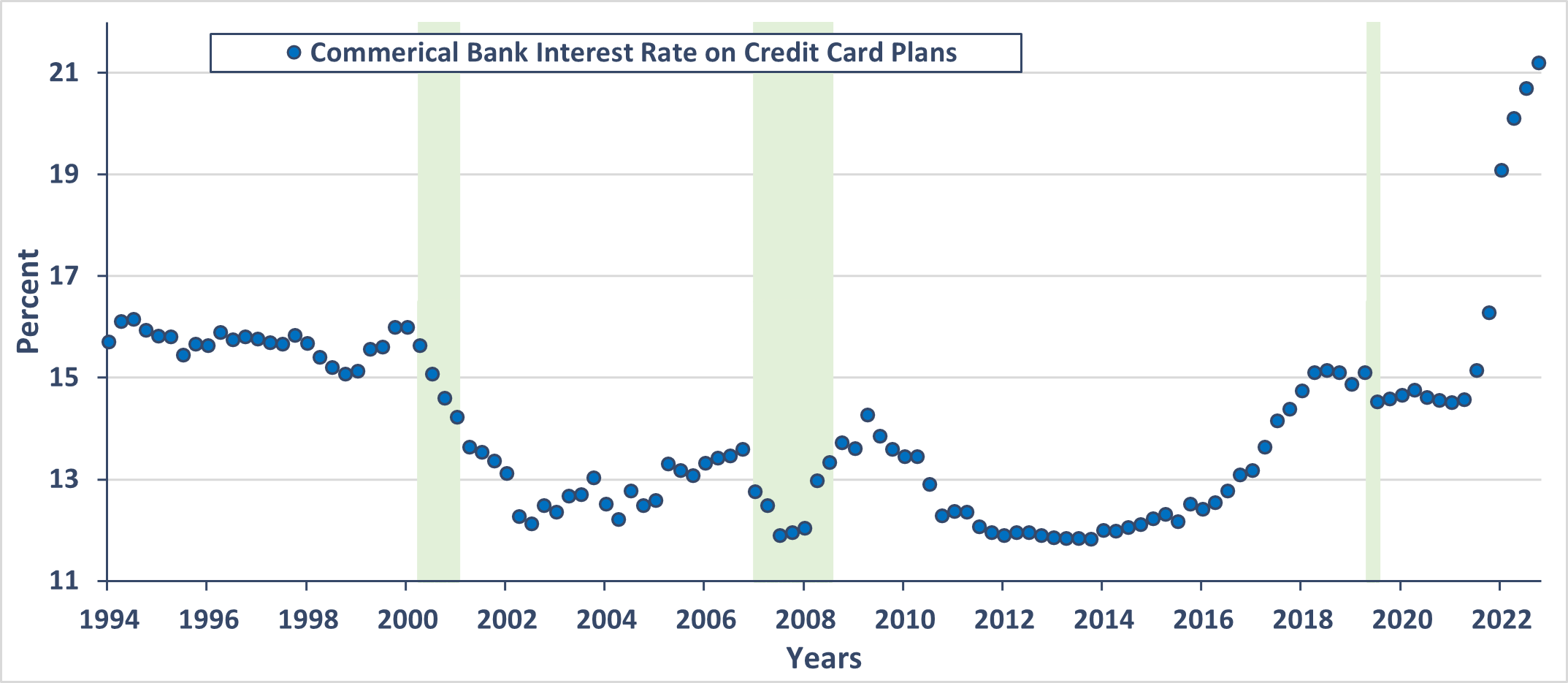

We would note one concern to the earnings outlook, and that is the consumer. Our first warning flag comes from credit card interest charges, which reached an all-time high this last quarter. Clearly the consumer’s shutdown stimulus money is gone.

Source: St. Louis FRED

Second, Dollar General lowered earnings guidance for 2023. Third, FedEx and UPS both said they expected lower volumes this Christmas season. So, let’s keep those warning flags in view to see if a retail storm develops.

Since we see Christmas stuff in the stores, we may as well get started on our Countdown 24. Sounds ominous, but here are a few thoughts that may impact earnings and therefore stock prices.

6 straight months of negative full-time job growth

5 Wars around the world. Space, cyber, Ukraine, Africa, Israel

4 Percent inflation should be your planning number.

3 Fed speakers last week signaling possible policy change.

2 trillion-dollar deficits last year and next. Oh, and over the last 70 years, the 10-year Treasury Note has averaged 2% above inflation. Let’s see: 3.7% CPI + 2% equals a 5.7% Note yield. Today it’s around 4.7%. Hmmm.

1 more quarter-point increase in short-term rates by the Fed if GDP growth stays at 2% or better.

0 Percent chance of a rate cut in the next six months.

Wrap-up

The flight to safety in bonds has moderated slightly. Gold, crude oil and the dollar remain elevated after the Hamas attack. The Fed may be signaling at least a pause in rate hikes, if not an outright end to the hike cycle. We are inclined to wait for Powell later in the week on this one.

We would love to see positive earnings surprises give the Bulls strength to break through resistance and kick off a typical fourth-quarter rally. Patience can be hard to come by but our indicators are telling us to stay put with a neutral weight on stocks and overweight to cash.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.