Still a bull, but bumpy markets shaking portfolios — Week of September 2, 2024

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 0.27 | 19.52 | 27.12 | 9.36 | 15.88 | 5,648.40 |

| Dow Jones Industrial Average | 1.07 | 11.75 | 22.06 | 7.71 | 11.79 | 41,563.08 |

| Russell 2000 Small Cap | -0.01 | 10.38 | 18.44 | 0.56 | 9.64 | 2,217.63 |

| NASDAQ Composite | -0.91 | 18.58 | 27.20 | 5.96 | 18.32 | 17,713.63 |

| MSCI Europe, Australasia & Far East | 0.61` | 12.47 | 20.10 | 4.77 | 9.23 | 2,449.04 |

| MSCI Emerging Markets | -0.05 | 9.80 | 15.46 | -2.71 | 5.13 | 1,096.34 |

| Barclays U.S. Aggregate Bond Index | -0.51 | 3.07 | 7.30 | -2.11 | -0.04 | 2,228.33 |

| Merrill Lynch Intermediate Municipal | -0.03 | 1.17 | 5.31 | -0.25 | 1.04 | 318.64 |

As of market close Friday, August 30, 2024. Returns in percent.

Investment Insights

— Steve Orr

High end

Talk about going out with a bang. In the final 15 minutes of trading on Friday, somebody or group caused quite a surge. During that brief span, the NASDAQ jumped 0.5% and the S&P 500 rose 0.3%. Some of the buying was from risk parity portfolios; bonds performed better than stocks in the month. Bonds were sold to buy stocks. Others, we guess needed some good marks in their portfolio. We wondered if that surge would hold. At least the Dow Industrials hit a new high. We are encouraged by the Dow and S&P 500 Equal Weight indices. Both are gaining ground at the expense of the tech-heavy NASDAQ. The broadening of positive price action to Health Care, Utilities and Financial sectors is a welcome strengthening of the underlying trend.

Easy financial conditions and the availability of funding in the markets has suppressed daily volatility. So, a “normal” August with a 6% drop and 8% rebound seems like a crazy volatile month. Warning: Those of us who walked to school uphill both ways remind you that was a reasonable month in history. September is here, and its time to cinch your seat belts. September ranks last in monthly performance, averaging a 1% loss for the month over the last 70 years.

Do take note of the current Bull cycle, however; Bespoke Research points out that the S&P 500’s 26% return over the last 12 months puts it in the 78th percentile of returns. Not bad at all. The broad investment grade bond market is up 6% over the same span. Not bad either, considering the hell of 2022 and most of 2023 for interest rates.

Big ledge

And the results are in for the first day of September. Friday’s rally would not hold. On cue, the NASDAQ dropped 3.3%, S&P 500 just a -2.4%. The Dow Industrials fared the best, only dropping 1.5%. We mentioned in prior missives our concern that only the Dow Industrials broke to new highs in last month’s rebound. The other major indices have all run back toward their prior highs and failed around August 23.

A Bull pattern continuation would have the index power through to a new high, come back down around the old new high level, muck around a few days then build higher. A selloff to retrace the lows of early August would start just like today: 3 or 4 stocks down for every stock higher. The percentage of stocks above their 10-day moving average would slip to around 40% from today’s 53%. The intermediate Bull trend remains intact as 73% of S&P 500 members are above their 200-day moving average. We would reassess our indicators if the selloff pulled that percentage below 60%.

Snow job

Last week we described the BLS annual job estimate revision and how it may affect the Fed’s thinking. The green eyeshade folks at the BLS think that by the time they are through with their annual estimate updates next February that monthly jobs from March 2023 through March 2024 may be around 68,000 less per month.

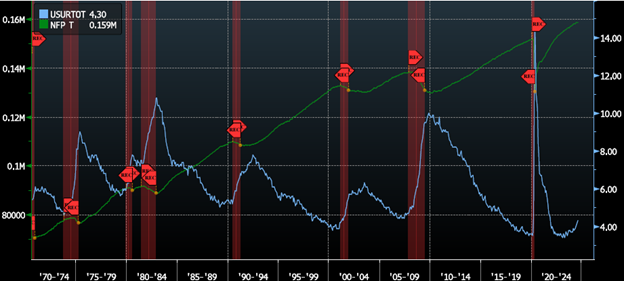

Whatever the final number is, it will be a meaningful reduction in growth over that period. We are confident that economic activity has slowed since March and further reductions may be necessary. These revisions combined with the upward creep in the Unemployment rate are likely the main drivers for the Fed’s newfound employment focus. We know history rhymes, thanks to Mark Twain. In the post gold-standard era (“ex Bretton Woods, in econ lingo), the unemployment rate has sprung higher at the same time total payrolls began to fall. Today we can stipulate that the unemployment rate has bottomed but not yet sprung. Total payrolls (green line) may be running out of steam (second derivative alert) but have not yet rolled over.

Source: Bloomberg, LP

This Friday’s August jobs report should show continued modest growth of 165,000 net new jobs and the unemployment rate improving to 4.1%. Both are consistent with a second gear economy that is coming off of a multi-year sugar high of federal deficit spending. The Most Anticipated Recession Ever is still months away at the soonest.

Two weeks!

We are a bit leery of cutting rates at this point. The Fed has a deserved reputation for cutting and raising rates too late in an economic cycle. Perhaps weaker data in the coming months will prove to us that the recession has already begun. Certainly, the comments by Dollar General’s CEO in its earnings call last week get our attention. “More of our customers report that they are now resorting to using credit cards for basic household needs and ~30% have at least 1 credit card that has reached its limit.” Ouch. The effects of the Fed’s rate increases from 0% to 5% are still being felt. Housing has been in recession for two years; manufacturing at least a year, if not 18 months. A rate cut in two weeks is immediate in market psychology impact, three months in housing and a year in the rest of the economy. For many pockets of the economy, relief will have to wait.

Wrap-Up

We are struggling to find a time when the Fed cut rates with times this “good.” Here in the U.S., unemployment is near 4%, the economy is growing at its long-term potential and earnings expectations for 2025 are in the double digits. Stay patient through the chop.

Steve Orr is the Managing Director and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.

Texas Capital Private Bank™ refers to the wealth management services offered by the bank and non-bank entities comprising the Texas Capital brand, including Texas Capital Bank Private Wealth Advisors (PWA). Nothing herein is intended to constitute an offer to sell or buy, or a solicitation of an offer to sell or buy securities.

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by PWA, including PWA’s Form ADV, Part 2A brochure and all supplements thereto, before making an investment.

Neither PWA, the Bank nor any of their respective employees provides tax or legal advice. Nothing contained on this website (including any attachments) is intended as tax or legal advice for any recipient, nor should it be relied on as such. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or legal counsel. The wealth strategy team at PWA can work with your attorney to facilitate the desired structure of your estate plan. The information contained on this website is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the authors and not necessarily those of PWA or the Bank.

©2025 Texas Capital Bank Wealth Management Services, Inc., a wholly owned subsidiary of Texas Capital Bank. All rights reserved.

Texas Capital Bank Private Wealth Advisors and the Texas Capital Bank Private Wealth Advisors logo are trademarks of Texas Capital Bancshares, Inc., and Texas Capital Bank.

www.texascapitalbank.com Member FDIC NASDAQ®: TCBI