Pause — Week of August 22, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | -1.16 | -10.40 | -2.60 | 15.25 | 13.73 | 4,228.48 |

| Dow Jones Industrial Average | -0.05 | -6.02 | -1.46 | 11.39 | 11.63 | 33,706.74 |

| Russell 2000 Small Cap | -2.90 | -12.14 | -7.12 | 10.66 | 8.94 | 1,957.35 |

| NASDAQ Composite | -2.58 | -18.36 | -11.96 | 17.93 | 16.46 | 12,705.21 |

| MSCI Europe, Australasia & Far East | -0.80 | -14.59 | -12.92 | 5.23 | 3.51 | 1,946.51 |

| MSCI Emerging Markets | -0.68 | -16.07 | -15.38 | 3.75 | 1.78 | 1,009.58 |

| Barclays U.S. Aggregate Bond Index | -0.27 | -9.14 | -9.97 | -1.28 | 0.96 | 2,139.95 |

| Merrill Lynch Intermediate Municipal | -0.85 | -6.18 | -6.50 | -0.26 | 1.49 | 300.32 |

As of market close August 19, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

Something big

All good times must end, or at least take a breather. U.S. stock markets could not muster a five-week run higher despite 2% thrust to start the week. Since its low on June 16, the S&P 500 has rallied just over 15% through Friday’s close. A nice, but very typical Bear rally. The NASDAQ, Dow Industrials and S&P 600 Small Cap all rose similar amounts. Each index ran up to its 200-day moving average, held for a day or two and moved lower Thursday and Friday.

Media reports pointed to meme stocks gyrating last week. That is the easy answer to volatility. We would point out to our readers that Friday was monthly and weekly expiration of options on stocks and indices. The rally did attract a lot of option volume over the last month. The notional amount of S&P 500 options expiring totaled over $2 trillion. Is that a record? If it is not, it is at least something big. Couple huge options expiration with low summer volume and prices are going to move. Not enough for a trend change, but enough to make one think over the weekend.

Well, we’re waiting?

That is one of Ted Knight’s best lines. Is the rally over? From a fundamental perspective, yes. Leading economic indicators and rates markets suggest more slowing ahead in the fall. Technically speaking, the late July upthrust kicked off several welcome Bull signals. A review of our indicators and signals over the weekend shows a Bull/Bear split that we have not had this year. Bull signals are encouraging but there are not enough “green lights” on our board to push client allocations away from neutral.

Markets keep circling around to the argument that things are going to get so bad, that the Fed has to stop raising rates. That may happen. But we are many trading days, perhaps even cycles away from that point. Fed models based on the Beveridge curve (job openings vs unemployment) suggest the Fed has barely begun. After you stop the beer curve jokes you realize that moving the unemployment rate 1% to 4.5% would mean about 1.7 million folks will lose their jobs. The Fed is serious about slowing inflation and the Beveridge curve is one of their guides. If the economy continues to slow, will the Fed stop raising rates when unemployment is sticky at 3.5% and SPX within 10% of its all-time high? Nope, no way.

Rain, please

We cannot find our copy of this year’s Farmers’ Almanac. Perhaps it was pushed off the desk by our fresh copy of Dave Campbell’s Texas Football. What is the weather forecast for this coming winter? We do not have a clue, but Europe’s winter is on traders’ minds. You may recall a couple of months back we mentioned that the Texas Panhandle wheat crop did not make. Other parts of the Midwest were able to fill in the gap. Our grain is transported by truck, train and river.

So too in Europe. Unfortunately, the same drought conditions that have hit parts of the U.S. are hitting Europe. The latest reports from the Rhine in Germany show their main trade artery is down to less than two feet in depth. This is slowing trade and causing prices for raw materials and their transport to spike. Fuel resources and natural gas inventories are already well below normal. The German government has a decision to make: at some level will they let people freeze to keep factories open, or shut parts of the economy to keep folks warm? Either way, the drought may stick around through the winter.

France is having trouble keeping two of its nuclear plants online because the rivers used to cool the plants are too low. Norway sells electricity via undersea cable to the U.K. The electricity is produced by hydro facilities from snowmelt lakes. Those lakes are so low from drought that Norway is considering rationing electricity sales. The U.K. consumer price index just hit a 40-year high in July. Low fuel inventories combined with higher transportation costs will be a further drag on their economies. Both add to current inflation and hurt earnings margins. We think European companies are in an earnings recession. Their home countries may already be in recession.

Wrap-up

Stock rallies tend to take over the news. Much of the bounce came from the mega-tech group. Apple rose 32% since mid-June. One can forget that the all-important dollar continues to pull in capital from around the world, making it harder for emerging market companies to compete. Interest rates remain in an uptrend but moving at a much slower rate than earlier in the year.

Our portfolios have benefited from the recent rally, but our indicators are not pushing for more risk exposure. We remain patient.

Essential Economics

— Mark Frears

Yawn

How well do you sleep? Do you have a newborn, or a teenager? You probably do not sleep much. Been there. Now that children are out of the house, we have a decent mattress and a good fan for white noise, I sleep great. There are many who do not have that luxury and it can have a huge impact. Sleep deprivation is no joke. The markets this week struggled to stay awake at times. Approaching the end of the summer (for those not in Texas), slower week for economic releases, and a desire to look into the future made for a less eventful week. I think we can find some things to look at!

Housing

The National Association of Home Builders (NAHB) Housing Market Index led off the week coming in at 49 for August, versus an expected 55. This was the first reading below 50 since May 2020. Building Permits for July were down 1.3% on a month-over-month (MoM) basis. Housing Starts were down 9.6% for the same period. Later in the week, Existing Home Sales were down 5.9% for July on a MoM basis. They have now fallen for six consecutive months and are 26% lower than the January peak.

Rising mortgage rates have taken buyers out of the market. Increasing supply is not helping either. Prices had risen on an unsustainable trajectory and this slowdown will bring prices back down. It is expected that this market will continue to slump as mortgage rates are higher than the low rates we have been accustomed to, as well as the uncertainty surrounding the economic climate. People will not make major purchases in uncertain times, even in a strong job market.

Future insight

The Conference Board’s Leading Economic Index (LEI) for July fell 0.4%. This is the fifth consecutive decline primarily due to consumer pessimism, decline in ISM new orders and building permits, and increasing jobless claims. In the last six months seven of the ten components have declined, increasing the risk for a recession.

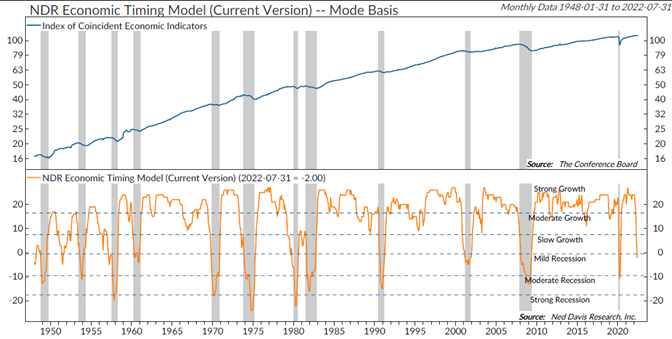

The chart below shows the Ned Davis Research Economic Timing Model (ETM). The mild recession indication in the lower right corner tells us that a slowdown is coming. This indicator has been accurate in all cases except one in 1951.

Source: Ned Davis Research

The omnipresent Fed

There is not a Federal Open Market Committee (FOMC) meeting in August, but that doesn’t mean they are not still front and center. While some indicators have shown a peak in inflation, we are still at higher levels than the Fed is comfortable with. While gas prices have come off their highs and we are supposed to be happy about this, high energy costs are still impacting us on multiple fronts.

Food prices are 13.1% higher than last year, per last week’s Consumer Price Index release. Multiple factors are at play here and the Fed may not be able to influence them by raising rates. Even before the war in Ukraine, we had a drought underway, already pushing food prices higher. Now, even with some grain ships able to navigate the Black Sea, we are still facing supply chain issues on the supper front. People must eat; that is one demand you cannot slow down by raising rates.

The minutes from the July 26 – 27 FOMC meeting came out last week and showed concern from the members about tightening short-term rates too much and choking off economic activity. That was what the media pulled from them. It did not take long for Fed “talking heads” to make their voices heard. Federal Reserve Presidents Bullard, Kashkari, Daly and George were all on the tape, and the undercurrent was that they would continue to raise rates to fight inflation and were hopeful this would not cause a deep recession.

There will be more Fed talk upcoming as they return to Jackson Hole, Wyoming, for their annual conference August 25 to 27. Primary attention will be paid to Chairman Powell as he speaks on the 26th. Last year he highlighted five reasons that elevated inflation readings were “likely to prove temporary.”

The next regular FOMC meeting is September 20 – 21 and short-term futures are currently divided as to whether they will raise rates 50 or 75 basis points.

Wrap-up

Even with a positive Retail Sales number this week, we still need to keep an eye on the war, inflation, Fed and earnings, as they will be the clearest indicators we see.

This week’s numbers did not keep me from getting a good night’s sleep. Maybe I am preparing for the uncertain times ahead.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 22-Aug | Chicago Fed Nat'l Activity Index | Jul | (0.25) | (0.19) |

| 23-Aug | S&P Global US Manufacturing PMI | Aug | 51.9 | 52.2 |

| 23-Aug | S&P Global US Services PMI | Aug | 50.0 | 47.3 |

| 23-Aug | S&P Global US Composite PMI | Aug | N/A | 47.7 |

| 23-Aug | Richmond Fed Manufacturing Index | Aug | (5) | 0 |

| 23-Aug | New Home Sales | Jul | 575,000 | 590,000 |

| 23-Aug | New Home Sales MoM | Jul | -2.5% | -8.1% |

| 24-Aug | Durable Goods Orders | Jul | 0.8$ | 2.0% |

| 24-Aug | Durable Goods ex Transportation | Jul | 0.1% | 0.4% |

| 24-Aug | Capital Gds Orders Nondef Ex Air | Jul | 0.3% | 0.7% |

| 24-Aug | Pending Home Sales MoM | Jul | -2.5% | -8.6% |

| 25-Aug | Initial Jobless Claims | 20-Aug | 252,000 | 250,000 |

| 25-Aug | Continuing Claims | 13-Aug | 1,443,000 | 1,437,000 |

| 25-Aug | GDP Annualized QoQ | Q2 | -0.9% | -0.9% |

| 25-Aug | Personal Consumption | Q2 | 1.5% | 1.0% |

| 25-Aug | Kansas City Fed Manuf Activity | Aug | N/A | 13 |

| 26-Aug | Wholesale Inventories MoM | Jul | 1.3% | 1.8% |

| 26-Aug | Personal Income | Jul | 0.6% | 0.6% |

| 26-Aug | Personal Spending | Jul | 0.4% | 1.1% |

| 26-Aug | Real Personal Spending | Jul | 0.4% | 0.1% |

| 26-Aug | PCE Deflator YoY | Jul | 6.4% | 6.8% |

| 26-Aug | PCE Core Deflator YoY | Jul | 4.7% | 4.8% |

| 26-Aug | UM (Go MSU) Consumer Sentiment | Aug | 55.5 | 55.1 |

| 26-Aug | UM (Go MSU) Current Conditions | Aug | N/A | 55.5 |

| 26-Aug | UM (Go MSU) Expectations | Aug | N/A | 54.9 |

| 26-Aug | UM (Go MSU) 1-year inflation | Aug | N/A | 5.0% |

| 26-Aug | UM (Go MSU) 5- to 10-year inflation | Aug | N/A | 3.0% |

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.