Rate Cage Match: Fed vs Street — Week of February 6, 2023

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 1.64 | 7.86 | -6.09 | 9.60 | 10.32 | 4,136.48 |

| Dow Jones Industrial Average | -0.15 | 2.44 | -1.33 | 7.81 | 8.18 | 33,926.01 |

| Russell 2000 Small Cap | 3.90 | 12.81 | 1.14 | 7.53 | 6.46 | 1,985.53 |

| NASDAQ Composite | 3.33 | 14.77 | -12.71 | 9.14 | 11.68 | 12,006.96 |

| MSCI Europe, Australasia & Far East | 1.17 | 9.84 | -2.38 | 5.17 | 3.32 | 2,133.83 |

| MSCI Emerging Markets | -0.53 | 9.37 | -10.82 | 1.45 | -0.51 | 1,045.56 |

| Barclays U.S. Aggregate Bond Index | 0.84 | 3.85 | -7.43 | -1.99 | 1.15 | 2,127.69 |

| Merrill Lynch Intermediate Municipal | 0.37 | 2.90 | -1.76 | 0.07 | 2.29 | 307.49 |

As of market close February 3, 2023. Returns in percent.

Investment Insights

— Steve Orr

Blowoff

Once again Chairman Powell’s press conference set off a market frenzy. This time, however, it was a rally in stocks and bonds. Lifting up the hood, two things stand out. First, there were a lot of fast-money players “de-grossing risk exposure.” That is a complex phrase for “frantically covering short positions.” Goldman Sachs reported the volume of short covering was the largest since November 2015. Second is the rise in zero-day options. Speculators and ex-spouses (day traders) have poured into same-day expiration put and call options as a way to day-trade market moves. A lot of the action Wednesday and Thursday had a near manic, blowoff feel.

If Wednesday’s market action was Powell, then Thursday’s was mega-tech earnings. Options traders positioning for the big three earnings announcements set a new daily record. More than 68 million contracts traded last Thursday; 40 million were calls. By comparison, the same day a year ago the entire day’s volume was just 45 million. The meme stock crowd has moved over to the options pits. Perhaps we will have to look elsewhere for thoughtful hedging tools.

Finally, Friday brought January’s Non-Farm Payroll release. According to the Bureau of Labor Standards, net business employment rose by 517,000 in January. The household labor force also rose by a head-scratching 894,000, pulling the unemployment rate down to a 53-year low of 3.4%. January’s report usually has some seasonal and data adjustment factors. We will be digging into the numbers to get a better handle on job growth. In eight of the nine previous months, employment growth was strong but trending lower. Regardless of the actual numbers, the labor market remains tight and Fed speakers can point to the headline and claim rates must continue to move higher.

Fed head said

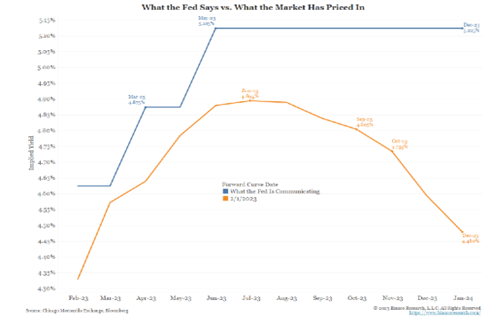

Wall Street has been fighting the Fed for the last year. The Street believes the Fed will not go as far as the Fed says. Wall Street also thinks the Fed will not hold rates at their high (“terminal”) level for very long. Again, contrary to numerous Fed speakers. Jim Bianco sums this fight up graphically (Fed in blue — high for longer, Wall Street in orange):

Chairman Powell started the sharp rally Wednesday by stating that the Fed “did not wish to overtighten.” Traders took that to mean the Committee would be cautious about raising rates much further. The “one and done” crowd proceeded to hit the “Buy” button. Careful listeners counted 11 times that the Chairman used the word “disinflation.” Oh boy! Inflation has been licked — hit “Buy!” Of course, the “one increase and done” crowd also ignored the fact that Powell said the word inflation 100 times in his 45-minute press conference.

This week comes the reality dose. Or reverse spin. Whatever you call it, almost immediately the Fed released a statement that the Chairman would be interviewed by David Rubenstein in D.C. tomorrow. Note: most Fed interviews are lined up weeks, if not months, in advance. Powell and other FOMC members will be out in force to remind traders that 1) the Fed is serious about beating inflation, 2) the Fed Funds rate may be close to inflation, but core inflation is still rising, and the Fed intends to hold short-term rates higher than the Street wants. We bet that Powell meant to say “slowing inflation” rather than disinflation — even though it is saying the same thing.

Fun frustration

Major market lows do tend to occur around high inflation peaks. CPI inflation peaked at 9%+ last summer, but traditional measures of market lows were not evident. The October lows may represent the Bear cycle low for stocks if a soft landing happens this year. The frustration for long-term investors is that the market’s rally over the last several weeks does not mesh with every economic statistic, save job reports, going lower.

If one graphs the survey and manufacturing reports against the job reports, they are going opposite directions. The only positive survey we can find are U.S. ISM Services, which moved up into mild expansion last month. That does fit with the jobs report, as there were large gains in the leisure and hospitality sectors (+128,000).

We remain in a Bear cycle inside of a long-term Secular Bull market. Countertrend rallies should fizzle after a few weeks. At some point, investor exhaustion sets in and the final lows are made. Our economic indicators are moving more into the red, suggesting weaker growth and lower corporate earnings in the coming quarters. Lower earnings mean multiples need to adjust lower. Housing has had its recession, now possibly tech and manufacturing.

Falling orders in both sectors over the last quarter may be a sign of the falling U.S. dollar and full inventories. If so, demand may pick up later in the year. That would underpin a soft landing if the consumer does not quit spending. Credit card receipts from the big operators suggest that consumers may be shifting to different stores or cheaper alternatives but are still spending. That does not sound like recession to us. Rallies are always fun, but the forward-looking economic indicators leave us frustrated and concerned that stocks and bonds are temporarily overbought.

February’s history may be just the ticket to work off overbought conditions. Typical Februarys see stock markets take a pause from a strong January start. Pre-election years have typically finished in the black, just not as strong as January and March. Over two-thirds of S&P 500 members are above their 200-day moving average. Rolling 10-day advancing stocks over declining stocks on the New York Stock Exchange hit 2:1 back in early January. There have been 28 of these 2:1 breadth thrusts since World War II. In all, 28 stocks were higher six months later. Since stocks generally lead the economy by six months to a year, that would fit with either a soft landing or mild recession scenario occurring in the middle of the year.

And of course

The earnings season is in full swing! About half of the members have reported. Blended Q4 2022 EPS growth has declined 2.7% year-over-year. Most analysts believe Q4 2022 earnings will decline 5.3% once all of the S&P 500 members report. FactSet notes that despite a disappointing earnings season, the 12-month P/E ratio for the S&P has increased from 16.7 to 18.5 due to index price increases year to date.

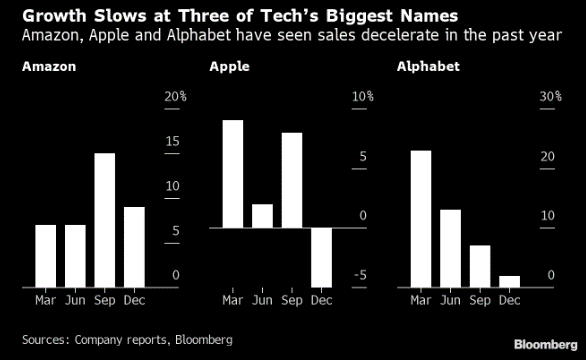

Mega-tech reported last week, and results were as expected. Amazon sales fell due to soft consumer demand for e-commerce product and slowing growth in AWS, the cloud services business segment. Sales of iPhone and Mac products declined more than analysts predicted, but Apple blamed the strong dollar and China lockdowns.

Google did not fare well either. Advertisers pared back expenses as they look to balance slowing economic growth and declining consumer sentiment. Meta was the outlier. Despite declines in sales for the third straight quarter, Meta is up 56% YTD. Perhaps that $40 billion buyback program has something to do with Meta’s recent surge in price….

This week a mix of consumer staples, consumer discretionary and communications names are on tap. Notable names include Tyson Foods, Chipotle, Disney, Pepsi and Hilton. Will be interesting to see how the market reacts to resurrected Disney CEO Bob Iger and his battle with activist Nelson Peltz. After years of underperformance, analysts wonder how assets like Hulu and ESPN fit into Disney’s long-term plans. Royal Caribbean Cruises reports on the 7th and is the ninth-best performing stock this year, up 38%. We will see what they have to say about inflation, fuel costs and, of course, bookings.

Wrap-up

The late great Marty Zweig coined the phrase “Don’t fight the Fed.” Powell and his fellow Committee members have their work cut out for them in convincing Wall Street that rates are going higher and staying for longer.

We also do not fight the tape. Recent tape action is positive, but in the face of deteriorating industrial activity. Our economic indicators continue to move into the recession zone. As earnings season winds down, markets may turn temporarily choppy.

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

The contents of this article are subject to the terms and conditions available here.