Still a Bear Rally… — Week of August 15, 2022

Strategy and Positioning written by Steve Orr, Chief Investment Officer; and Essential Economics written by Mark Frears, Investment Advisor

| index | wtd | ytd | 1-year | 3-year | 5-year | index level |

|---|---|---|---|---|---|---|

| S&P 500 Index | 3.31 | -9.35 | -2.64 | 15.39 | 13.86 | 4,280.15 |

| Dow Jones Industrial Average | 2.99 | -5.98 | -3.02 | 11.01 | 11.47 | 33,761.05 |

| Russell 2000 Small Cap | 4.97 | -9.51 | -9.07 | 11.46 | 9.33 | 2,016.62 |

| NASDAQ Composite | 3.10 | -16.20 | -11.27 | 18.65 | 16.93 | 13,047.19 |

| MSCI Europe, Australasia & Far East | 2.48 | -13.65 | -13.87 | 5.58 | 3.75 | 1,970.07 |

| MSCI Emerging Markets | 1.19 | -15.89 | -18.97 | 4.24 | 2.15 | 1,014.29 |

| Barclays U.S. Aggregate Bond Index | -0.12 | -9.22 | -9.56 | -1.11 | 0.96 | 2,137.95 |

| Merrill Lynch Intermediate Municipal | 0.02 | -5.38 | -5.66 | 0.11 | 1.65 | 302.90 |

As of market close August 12, 2022. Returns in percent.

Strategy & Positioning

— Steve Orr

Not yet

The S&P 500 put up an impressive 3.3% run last week, its sixth in the last eight weeks. The summer is moving quickly (thankfully), and we are now two months on from the 3,666 low. Long-time Wall Street economist Ed Yardeni pointed out the eerie coincidence of the 2008-09 Financial Crisis low: 666, now 3,666. Below we look at recent action to see if 3,666 could be this cycle’s low.

Only China’s market was down for the week. Every developed market rose at least 1% except the poor Swiss. Over the last month the story is the same. In line with our indicators, the U.S. has led the performance parade. The countertrend rally has certainly calmed some traders, but as we mentioned last week, the first-half drop and rebound are typical Bear cycle occurrences.

Longer term interest rates are nearly one-half of a percent lower than their mid-June peak. Short rates are following the Fed’s orders and holding near their recent highs. The two-year Treasury touched 3.25% late last week, a sign that traders expect more rate increases from the Fed.

Plan B

We are rarely fans of the consensus view. Our philosophy, born of hard knocks, humility and research, is to take what the market is giving us and make sure we are correctly positioned for the intermediate and long-term trends. Our indicators and research point to another leg down in the short term for stocks as softer economic data rolls in from here and abroad. Past the fall, we still believe there will be a mild recession into the spring, followed by accelerating earnings and a rebound. That is short-term caution, and we find more commentators and media coming to our view.

We fear that means the market “herd” is coming around to our view. When you are part of the herd you become average or get average returns. In the herd, several things can happen: 1) a stampede and you get run over, 2) grumbling at the gates of the slaughterhouse, or 3) crowding into narrow trades that suddenly turn sour. There is no doubt that the economy ran slower through the middle of the year. Recent statements from Fed members affirm that the Fed will continue raising rates until inflation squeals. A Fed Funds overnight rate of 4% is just three one-half percent increases away and we have three meetings left this year.

Herd path?

It is very possible that a 4% overnight rate combined with a smaller Fed balance sheet could have the economic effect of a 4.5% to 5% interest rate. If food and rent prices roll over in the first quarter of next year, then we could see a path for inflation to moderate to 6% levels in January. By May they could touch 4% and monetary policy would be roughly neutral (Fed Funds – inflation = 0). What would that mean for company earnings and thus stock prices? Third and fourth quarter of this year would see inventory reduction sales and losses taken on inventories in some industries. Walmart reports this coming Wednesday and analysts expect inventory levels to be a top concern.

In 2023 earnings could rebound thanks to less fear of rate changes and recovery from a mild slowdown. We assigned a high probability to that outcome, but now that the herd is at our slowdown corral, we wonder about Plan B, or some lesser probable outcome.

What if

The market gave a rally, and nobody came? Commodity trading firms appear to be light on stocks and should be buying. It is summer and most of the tape action last week seemed to be short covering. Most indices are racing up toward their 200-day moving average. Trend and breadth indicators have moved quickly toward overbought ranges. Next week is options expiration Friday. There is plenty of dealer hedging yet to go. So, for the first time in months, there may be positive demand for stocks.

Credit spreads and growth stocks have had a very good run since mid-June. U.S. corporate bonds, as measured by the ICE BofA Corporate Master, have risen over 3.5%. High Yield is up over 6%. These are bellwethers that usually show stress before economic data turns down. Well, it is true that both hit the skids very quickly earlier this year, -15% and -13% respectively, from the start of the year through June 16. Are rates markets telling us, yes, higher rates ahead but companies can handle it? Possibly.

Positive job growth and easing of pump prices have consumers feeling slightly better than they did in May. Manufacturing surveys have come off their highs but remain in expansion territory. We had assigned a reasonable probability to the economy sliding down so far that the Fed would have to pause. A better Plan B would have the Fed pause in the spring because the economy is already beginning to recover and find its way around inflation.

Wrap-up

The Fed has a quite a road ahead in its inflation battle. Earnings over the next two quarters will feel the impact of the strong dollar, higher interest rates and still rising prices for some inputs. A number of sectors are coping with supply chain and inflation issues. Prudence dictates we assign some probability to a nascent recovery this winter.

Our indicators and caution have kept us neutral through the market downturn. If the consensus is right and we do hit a soft patch in the coming weeks, our portfolios are positioned to take advantage.

Essential Economics

— Mark Frears

Bounce house

When the boys were young, we had a birthday party at our house. The decision was made, although this house had a very small backyard, to rent a bounce house castle. It was delivered and we drug it into the yard, hooked up the compressor and started to inflate. It grew and grew, taking up every inch of the designated space, plus more! It was huge. Inflation for the consumer is a huge issue. Inflated prices have eaten into purchasing power. Last week, we had the latest releases for inflation. Did the bounce house continue to expand?

Data

Going into last week, Consumer Price Index (CPI) was the most-watched number. We were coming off a headline year-over-year (YoY) rate of 9.1% and the worry was that this would continue or go up. This came in at 8.5%, lower than expected. The Core measure that takes out Food & Energy came in at 5.9%, the same as last month. As you have no doubt noticed, the price at the pump has dropped significantly and this is what drove the improvement.

We also had Producer Price Index (PPI), coming in at -0.5% for the month and YoY dropped from 11.3% in June to 9.8% in July. Moving in the right direction. Unit Labor Costs for the second quarter dropped also, but still high at 10.8%. The cost of hiring is still a drag on companies.

University of Michigan (Go State) inflation component for five to 10 years out rose 0.1% to 3.0%, but the one-year measure dropped to 5% from 5.2%. Another release that did not get many headlines came from the New York Federal Reserve Bank. They put out a monthly Underlying Inflation Gauge (UIG) and this “full data set” came in at 4.7%, down 0.1% from June.

The data for the week showed an improving picture for inflation. What does this mean?

Perception

Nationwide, pump prices are below $4 per gallon, down 21% from the June peak, but still 25% higher than a year earlier. This not only helps PPI and CPI but has an immediate impact on consumers. Now they have more money to spend, and it should help their outlook. The University of Michigan (Go State) Consumer Sentiment rose from 51.5 to 55.1 for August, a 7% improvement.

Economic health is the driving force between voting for or against the existing party. Keep this in mind as we approach mid-term elections in November.

Impact

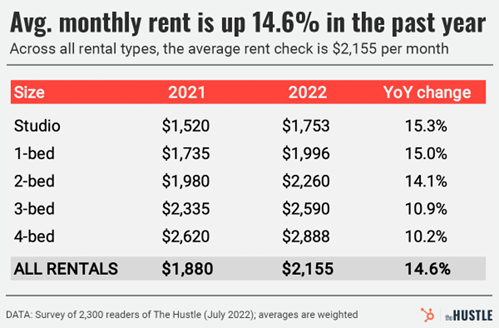

While transportation costs are easing a bit, the cost of housing is still increasing with new leases up as much as 14.6% in a small study done by The Hustle.

Source: The Hustle

The Cost of Shelter captured by the CPI is also still increasing, as it factors in on a lagging basis.

Our view of cost must expand outside the U.S. as the strong dollar is allowing us to ramp up imports. Obviously, the war in Ukraine, while showing a few signs of outgoing ships, will continue to impact the world with lower food, fertilizer and petroleum exports. While Europe is more impacted by fewer energy imports, they are now contending with low river water levels, inhibiting transportation of goods.

Do not get your hopes up for an immediate impact of the Inflation Reduction Act (IRA) passed by Congress last week. This is the former Build Back Better deal with a new label. The non-partisan Congressional Budget Office found it would reduce the deficit by $102MM over, wait for it, the next ten years. This is not the savior for our inflation concerns.

Future

With these improving inflation numbers this week, does this mean the FOMC has accomplished their job? Not. As Steve has been saying for months, they are late to the game and will end up having to do more than they should. Futures show them raising rates to a terminal rate of 3.55% sometime in the first/second quarter of next year. That will increase the current Fed Funds target rate by 1 – 1.25%; will that bring inflation down from 5 – 8% (depending on your measure) to the long-term goal of 2%?

Labor and energy costs have far-reaching impacts, and they will not go quickly into the still night.

Wrap-up

Truth be told, the adults had just as much fun as the kids in the bounce house. We are living in a time of an inflated cost of living. The question still is how far the Fed will have to go to bring down the demand side of the equation. We still feel the U.S. economy has enough underlying strength to not have a severe downturn.

| Upcoming Economic Releases: | Period | Expected | Previous | |

|---|---|---|---|---|

| 15-Aug | Empire Manufacturing | Aug | 5.0 | 11.1 |

| 15-Aug | NAHB Housing Market Index | Aug | 55 | 55 |

| 16-Aug | Building Permits | Jul | 1,650,000 | 1,685,000 |

| 16-Aug | Building Permits MoM | Jul | -2.7% | -0.6% |

| 16-Aug | Housing Starts | Jul | 1,530,000 | 1,559,000 |

| 16-Aug | Housing Starts MoM | Jul | -1.9% | -2.0% |

| 16-Aug | Industrial Production MoM | Jul | 0.3% | -0.2% |

| 16-Aug | Capacity Utilization | Jul | 80.2% | 80.0% |

| 17-Aug | Retail Sales MoM | Jul | 0.1% | 1.0% |

| 17-Aug | Retail Sales ex Autos MoM | Jul | 0.0% | 1.0% |

| 17-Aug | Business Inventories | Jun | 1.4% | 1.4% |

| 17-Aug | FOMC Meeting Minutes released from 7/27 @1p.m. CT | |||

| 18-Aug | Initial Jobless Claims | 13-Aug | 265,000 | 262,000 |

| 18-Aug | Continuing Claims | 6-Aug | 1,450,000 | 1,428,000 |

| 18-Aug | Philadelphia Fed Business Outlook | Aug | (5.0) | (12.3) |

| 18-Aug | Existing Home Sales | Jul | 4,890,000 | 5,120,000 |

| 18-Aug | Existing Home Sales MoM | Jul | -4.5% | -5.4% |

| 18-Aug | Leading Index | Jul | -0.5% | -0.8% |

Steve Orr is the Executive Vice President and Chief Investment Officer for Texas Capital Bank Private Wealth Advisors. He holds a Bachelor of Arts in Economics from The University of Texas at Austin, a Master of Business Administration in Finance from Texas State University, and a Juris Doctor in Securities from St. Mary’s University School of Law. Follow him on Twitter here.

Mark Frears is an Investment Advisor at Texas Capital Bank Private Wealth Advisors. Steve has earned the right to use the Chartered Financial Analyst and Chartered Market Technician designations. He holds a Bachelor of Science from The University of Washington, and an MBA from University of Texas – Dallas.

The contents of this article are subject to the terms and conditions available here.